摘要:物业亏损为何还在运营?,物业亏损却仍在运营,这是一个复杂的现象,涉及多方面的原因。,首先,物业行业存在诸多成本,如人力、设备维护、清洁等日常开支庞大。在收入无法...

团购威信:1

80898

2870

物业亏损为何还在运营?

物业亏损却仍在运营,这是一个复杂的现象,涉及多方面的原因。

首先,物业行业存在诸多成本,如人力、设备维护、清洁等日常开支庞大。在收入无法覆盖这些成本的情况下,亏损似乎难以避免。

其次,市场竞争激烈,部分物业为了争夺市场份额,可能选择降低服务价格或增加不必要的支出,这进一步加剧了亏损状况。

再者,一些物业可能存在管理不善的问题,如设施陈旧、人员冗余等,这些问题直接影响了物业的盈利能力。

此外,外部经济环境的变化,如经济衰退、政策调整等,也可能对物业的盈利造成冲击。

综上所述,物业亏损仍在进行运营的原因是多方面的,需要从管理、市场、成本控制等多角度进行深入分析并采取相应措施来改善这一现状。

Why Do Property Companies Continue to Operate at a Loss?

In the complex world of real estate, property companies play a pivotal role. However, many of them find themselves operating at a loss despite this crucial role. This phenomenon is not uncommon and can be attributed to a variety of reasons. Let"s delve into the reasons behind this trend.

1. High Initial Investment and Low Return on Investment (ROI)

One of the primary reasons property companies operate at a loss is due to the high initial investment required. Real estate development is a massive undertaking that involves purchasing land, constructing buildings, and completing various amenities. The costs associated with these activities are often substantial, and in many cases, the return on investment is not immediately apparent. The delay between the investment and the realization of profits can lead to financial instability and even losses during the construction phase.

2. Market Fluctuations and Economic Cycles

Real estate markets are inherently volatile and influenced by economic cycles. During economic downturns, property values decline, and sales volumes decrease. This can result in lower revenues for property companies, which may not be sufficient to cover their operational costs. Additionally, interest rates fluctuations can impact the cost of borrowing, further complicating the financial situation of property companies.

3. Overestimation of Future Profits

Property companies often make assumptions about future market conditions and profits. These assumptions can be based on past data or market trends, but they may not always materialize as expected. Overestimating future profits can lead to overinvestment in projects, which can exacerbate financial losses. Conversely, underestimating future profits can result in missed opportunities for growth and profitability.

4. Intense Competition

The real estate industry is highly competitive, with numerous players vying for market share. To remain competitive, property companies may need to engage in price wars, offering discounts and incentives to attract customers. While this can help increase sales volumes, it can also erode profit margins. Moreover, the need to constantly innovate and improve service offerings can lead to increased costs, further contributing to financial losses.

5. Regulatory and Legal Challenges

Real estate development is subject to various regulations and legal requirements, which can vary significantly across different regions. Navigating these regulatory landscapes can be time-consuming and costly. Non-compliance with regulations can result in fines, legal action, or even project delays, all of which can contribute to financial losses. Additionally, changes in legislation can impact property values and market conditions, creating uncertainty and potential risks for property companies.

6. Inadequate Risk Management

Effective risk management is essential for the success of property companies. However, many companies struggle to identify, assess, and mitigate potential risks. Poor risk management can lead to financial losses due to unforeseen events, such as natural disasters, economic crises, or changes in market conditions. Without proper risk management practices, property companies may find themselves unprepared to handle unexpected challenges, leading to prolonged periods of financial instability.

Conclusion

In conclusion, the reasons why property companies continue to operate at a loss are multifaceted and complex. High initial investment, market fluctuations, overestimation of future profits, intense competition, regulatory challenges, and inadequate risk management are all significant factors that can contribute to financial losses. To overcome these challenges and achieve sustainable profitability, property companies must adopt strategic measures, including better financial planning, market analysis, risk management, and innovation. By doing so, they can navigate the volatile world of real estate and secure their long-term success.

咨询威信:1898⒉8470

关注公众号获取实时房价信息

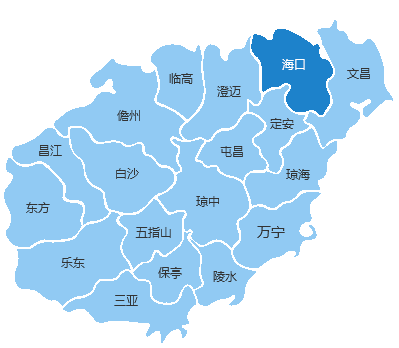

海南房产咨询师